A Difficult Conversation About College Costs

My Daughter Jaiden is a straight-A student this (her senior) year.

She currently works in fast food and has done a really great job saving most of her paychecks. She’s also taken criminal justice for two years at her high school and is a teacher’s aide for the class this year. A few months back the local police chief singled her out by name and told the teacher to make sure she applies for their internship program this summer.

I thought that sounded like the path she was going to take.

Then in November she started telling people that she was going to go to NAU (Northern Arizona University) in Flagstaff to study engineering and architecture. I’m a little dubious about the engineering part, as I’m not quite sure she understands the kind of math that sort of degree would involve.

But I let her run with it. I even let her fill out the application, thinking she’d either hit a roadblock, or realize herself that this idea might be little above and beyond.

We talked a little more about it last weekend and ended the conversation with her telling me there was a $300 acceptance fee, but she could pay it herself, and “it’s not really due until the summer”.

A couple of days later, while we are in Chicago, she texts me to say she paid the acceptance fee and wants my advice about about housing and eating plans.

Yikes!!!!

This had gone further and faster than I had intended.

It was time to have the talk I was hoping to avoid, but really should have had much sooner.

First a little background …

My oldest son is 35 and my youngest daughter is 15. I have five children by birth and over the course of my adult life have also had a part in raising five more during their youth and/or teenage years. That’s 10 altogher. I’m not entirely sure how this happened. In fact, when his mom was pregnant with my currently 17 year old, her step-brother (who was about 8 at the time) remarked that he thought we didn’t even like kids.

I do … love them all.

But it’s a minor miracle I have two dimes to rub together right now.

Don’t get me wrong, I’m doing okay, but just not (send 10 kids to college) weathy.

Or as I put it to my daughter more recently …

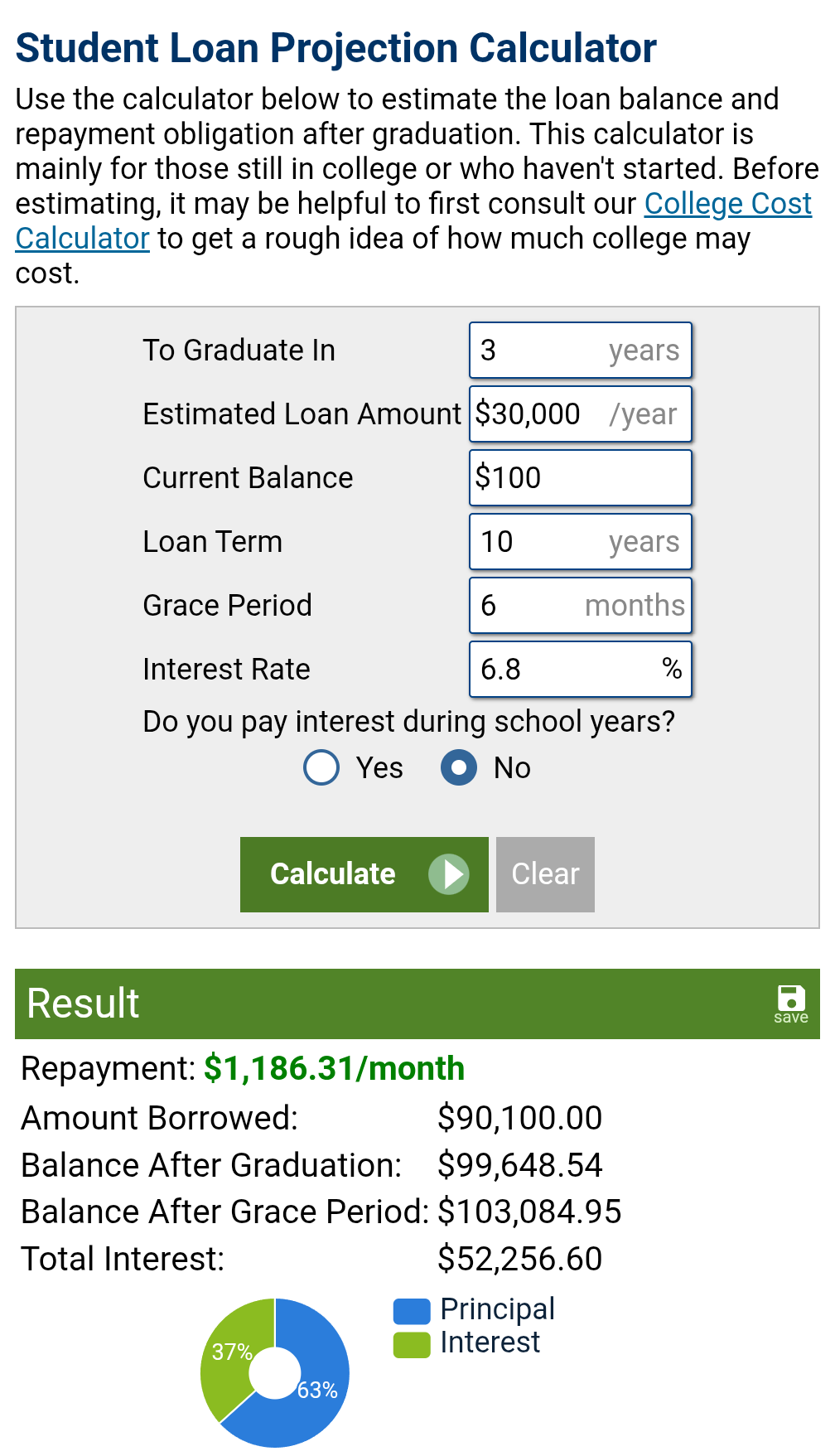

I have “help with community college” money, not $30K a year university money.

So we talked …

I started out by telling her how proud I am of her for taking the initiative to think about her future. I also acknowledged that between her savings and a small settlement she has from a car accident two years ago, she could likely swing a semester, or even the first year all on her own.

But what about the next 3 years?

You might not be surprised to learn that she hadn’t really thought about that.

I had though. 😐

Her response to this realization was a bit more predictable …

Wait, so either I don’t go, or I end up $100,000 in debt?

I am ever the optimist (you really don’t know what might happen), so I told her that it’s not necessarily that cut and dry, but those are the two most likely outcomes. But I also told her that I’d be happy to help her talk through some options.

We have a bit of recent experience with this sort of thing. This past spring after he graduated, Kelly’s son really wanted to go run at a college (Paradise Valley) in Phoenix. His potential situation was not quite as daunting. But housing and food ($1,000-$1,500 a month) were still going to present issues. After a couple of weeks of soul searching, he decided to join the Navy.

I of course presented this as an option for my daughter too, based on my own youthful experiences:

She is not so sure about that option. At the moment, her line in the sand is that she’d have to take our her piercings. (I’m not positive that’s the real end of the discussion, but I’m not pushing it).

She’s also not a fan of staying at home for a couple more years to knock out her core classes at the local community college while saving more money … although if I had to bet right now, this is probably the most likely path she’ll be on at this time next year … especially if she does the police internship.

I’m not sure exactly where/how this is going to go.

She had a few tears while we were talking last night, but then woke up this morning with a smile and positive demeanor. I am very lucky that she’s such a smart and sensible kid.

For now, we’re just going to keep talking, and I’m going to keep doing my own research so that I can be well informed as I try to guide her.

I don’t want to be a dream killer.

But I also can’t let her make a potentially life altering mistake.

Nobody ever said parenting would be easy.

So how did (or would you) navigate this middle-class dilemma (not enough income to outright pay for college, but too much for grants and aid)?

Til next time,

Todd

p.s. if you’re not a subscriber yet, I’d love to have your join our little group. If you do already subscribe, thank you! Please consider sharing this post with others:

OK, I have a little background on this one.

JUCO if possible will take care of the prelim classes (make sure they'll transfer to NAU).

The $300 should still be safe since that's for the app fee.

Online is a great option and it's usually 50% less (entry level classes are great for this) and this is a great way to start for a year to trim some costs and she can still work.

Work on campus - lots of students do it and there are lots of jobs there.

Apply for ever scholarship known to man - they stack and there are thousands of them

I don't know the rules at NAU, but since she's a good student, ask about scholarships from the school.

For an engineering degree, see if she can get into an accelerated degree program so she can earn her BA and MA in four years. She'll work hard but trim cost down and in her degree, a MA is pretty much required for a god job.

If she still has another year of HS, get into the dual enrollment program and take college courses at NAU for half the cost. The freshman classes are not any harder than HS classes

And yes, lots and lots of math in her program.

Sorry to bomb you with all of that - a bit of a brain dump

https://in.nau.edu/gear-up/what-is-dual-enrollment/

https://nau.edu/admissions/military-veterans/

https://nau.edu/online-degrees/

I get your dilemma. My personal experience was significantly different from what you’re describing now. But I’m hoping to add something constructive.

My dad passed away when I was 11, and my mom struggled financially. There was no money for college. My mom urged me to go to junior college for two years then transfer to a university, but I didn’t want to do that (for a number of reasons). So I did a gap year. I worked full time as a bank teller, saving as much money as possible during that year. I also worked as a bank teller during college.

Not only did my gap year give me an edge financially, it reduced the amount of money I had to borrow via school loans, and it directly inspired me to major in finance. I don’t think I would have discovered my career passion if it weren’t for my gap year, and working at a bank.

My college loan rate was 9% since I went to college during the early 1980s when the prime rate was like 21%. So my school loans were a huge expense for me.

I ended up financing about 50% of my tuition via school loans, and paying the remainder from my own savings via working during my gap year and during college.

I don’t know if she would be willing to do a gap year, but that could be considered.